Community Reinvestment Act Clinton

Subprime Disaster - President Clinton Takes Credit for Community Reinvestment Act Loans - YouTube. President Clinton laid down four principles as necessary for financial modernization.

William J Clinton Academy Of Achievement

President Clinton made clear that he was prepared to veto long overdue legislation to modernize the financial landscape if it allowed a bank with an unsatisfactory CRA rating to.

Community reinvestment act clinton. The preservation of the vitality of the Community Reinvestment Act effective consumer protections business choice and continued separation of banking and commerce. Created in 1977 with the intent of ensuring Black folk access to capital for growth in low-income urban and similarly struggling rural areas the Community Reinvestment Act was an ambitious attempt at solving problems faced by minorities whose loans had been denied at an alarming rate. The Community Reinvestment Act CRA enacted in 1977 requires the Federal Reserve and other federal banking regulators to encourage financial institutions to help meet the credit needs of the communities in which they do business including low- and moderate-income LMI neighborhoods.

In their words blacks were denied credit others would have been granted and missed out on home ownership as a result. Community Reinvestment Act Fair Housing Act and Equal Credit Opportunity Act. But in the face of all these factors some have fixed their attention instead on a formerly obscure 32-year-old statute the Community Reinvestment Act CRA.

During the 1990s former Clinton aides bragged that more aggressive enforcement of the Community Reinvestment Act pressured banks to issue riskier. In 1977 Democratic President Jimmy Carter passed the Community Reinvestment Act to provide housing to poor people. It is the subject of heated political and.

However SouthernDemocrat you are not wrong when you assert that the problem in the current crisis is that all these toxic assets were made possible by a special kind of derivative called a Credit Default. The Carter-era Community Reinvestment Act forced banks to lend to uncreditworthy borrowers mostly in minority areas. Democrats and the media insist the Community Reinvestment Act the anti-redlining law beefed up by President Clinton had nothing to do with the subprime mortgage crisis and recession.

This agrees with SgtRocks assessment that the Community Reinvestment Act is responsible for the banking crisis as this legislation affected only credit limits not interest rates. Operating under that requirement Fannie Mae in particular. Despite warnings from GOP members of Congress in 1992 Clinton pushed extensive changes to the rules requiring lenders to make questionable loans.

OCC Contact Information for Certain Notices and Posters August 05 2021 Source. The basis for the argument is that in 1992 Congress that Fannie and Freddie increase their purchases of mortgages for low-income and medium-income borrowers I believe through a 20 year old law called the Community Reinvestment Act. Answer 1 of 2.

The act initially merely sought data on banking practices to encourage lenders to practice fairness in granting mortgages. The CRA was based on the assumption that racist lenders denied mortgages to credit-worthy would-be borrowers particularly minority applicants. Was Clinton responsible for the Financial Crisis.

These well-intended rules were supercharged in the early 1990s by President Clinton. But President Bill Clinton in 1995 added teeth to the CRA. Please contact your supervisory office.

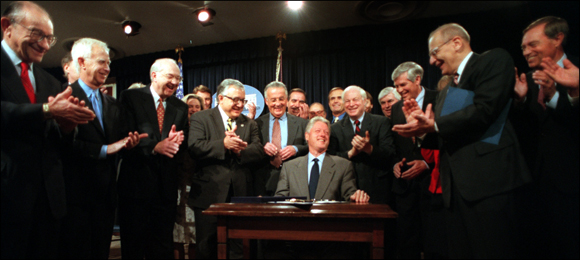

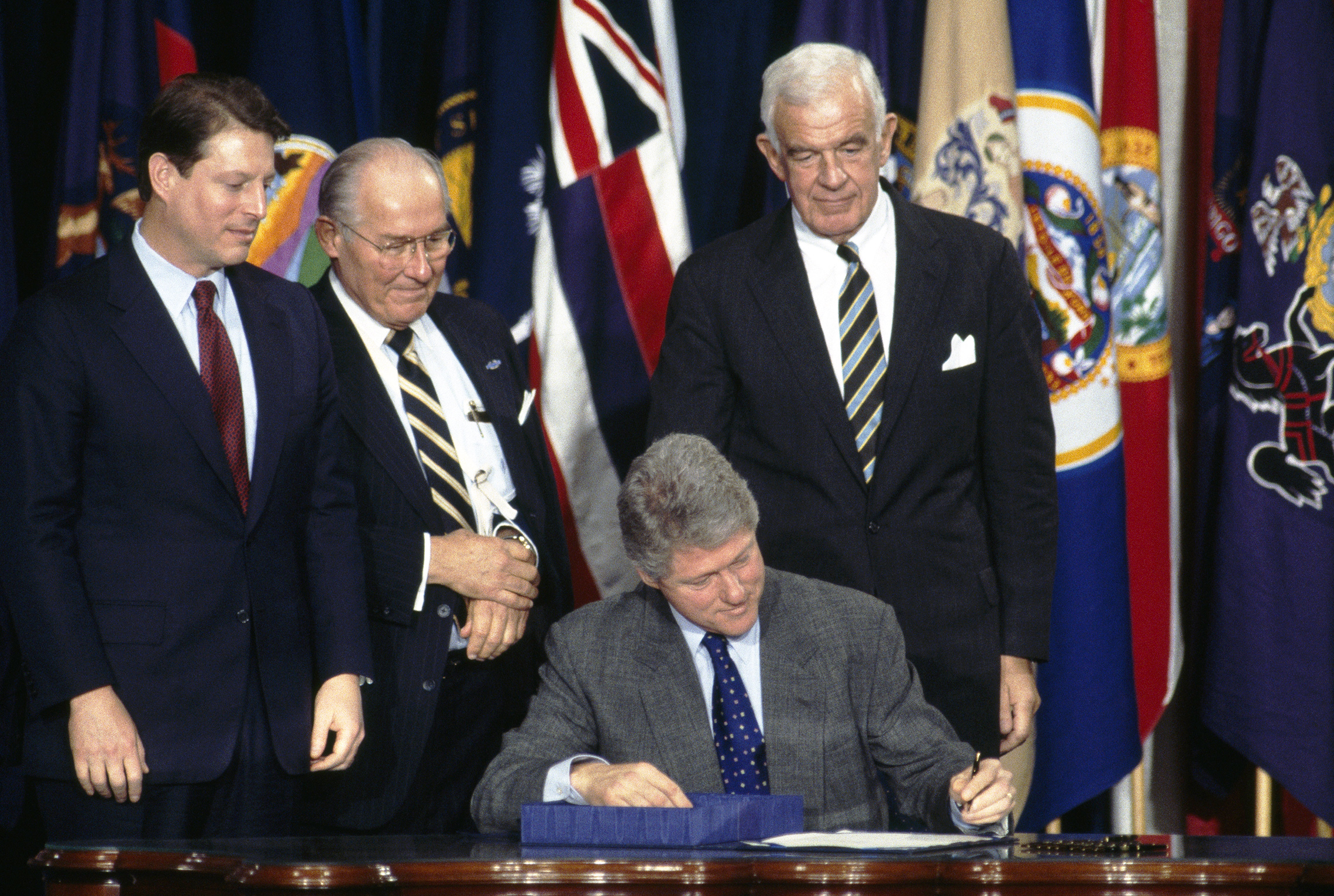

Fighting to Preserve the Community Reinvestment Act CRA under Financial Modernization. Community Reinvestment Act CRA In a major 1993 domestic policy speech on the South Lawn of the White House a considerable portion of Clintons statements challenged federal bank regulators to breathe new life and new purpose into the CRA. In 1995 Clinton loosened housing rules by rewriting the Community Reinvestment Act which put added pressure on banks to lend in low-income neighborhoods.

The study was disproved pretty quickly but the CR. In the early 1990s the Boston Fed did a study showing redlining in minority neighborhoods. The Community Reinvestment Act CRA is a federal law enacted in 1977 to encourage depository institutions to meet the credit needs of low- and moderate-income neighborhoods.

As it has evolved the Community Reinvestment Act has gradually increased regulatory pressure on lending institutions mandating a widespread loosening of lending standards. Echoing much of the conservative blogosphere The Wall Street Journal in September 2008 assigned CRA blame for the ongoing crisis albeit behind the Federal Reserve banking regulators and a credit-rating oligopoly. Der Community Reinvestment Act kurz CRA ist ein Bundesgesetz in den USA das seit den 1970er Jahren so genanntes Redlining also die Beschränkung von Kreditangeboten auf wohlhabende Wohngegenden bzw.

Unintended Consequences of Increased Regulation The relaxation of lending standards is a significant component of the mortgage crisis. And thanks to rules adopted in 1995 under the Community Reinvestment Act regulated banks as well as savings and loan associations had to make a certain number of loans to borrowers who were at or below 80 of the median income in the areas they served. In the 1990s Bill Clinton.

The Community Reinvestment Act. The Federal Housing Administration was competing with Fannie and Freddie for the same mortgages.

The Untold Story Of How Clinton S Budget Destroyed The American Economy

Community Reinvestment Act Of 1977 Federal Reserve History

The Legacy Of The Clinton Bubble Dissent Magazine

Economic Growth Clinton Digital Library

Power Of Progressive Economics The Clinton Years Center For American Progress

President Barack Obama And First Lady Michelle Obama At A Reception In The Oval Office With President Clinton Senator Ted Kennedy Vp Biden And Other Guests Prior To Signing Of The Kennedy

William J Clinton Academy Of Achievement

Clinton Library On Twitter In 1995 President Clinton Strengthened The Community Reinvestment Act S Banking Regulations And Increased Mortgage Lending To Low And Moderate Income Families By 80 Percent 5 6 Https T Co Zz4laixlvj Twitter

Clinton Campaign Speech C Span Org

Phil Gramm Says Loose Money And Politicized Mortgages Caused The Financial Market Crisis Wsj

President Clinton S Community Reinvestment Act Reform Initiative And Enforcement Of Federal Fair Lending Laws Subcommittee On

Bill Clinton Asset Or Distraction Cnnpolitics

William J Clinton Academy Of Achievement

Community Reinvestment Act Of 1977 Federal Reserve History

Posting Komentar untuk "Community Reinvestment Act Clinton"